November 2023 Newsletter – All About Cyber Insurance

The cyber insurance market is growing globally particularly in the USA, Germany, and India. But what is cyber insurance? Cyber insurance is a policy with an insurance carrier to mitigate a businesses’ financial risk exposure by offsetting costs related to damages and recovery after a data breach, ransomware attack, or another cybersecurity incident. Protecting your data from ransomware attacks is not just a priority—it’s imperative. Modern organizations need a solution that not only saves IT administrator’s time but also ensures business continuity by providing a disaster recovery process that is built for modern enterprise IT environments. Cyber insurance has been adopted globally. The top industries that have adopted cyber insurance are Healthcare, Technology, Manufacturing, Government, Financial Services, and Education.

Cybersecurity incidents are costly. It’s not just about the breach of information. According to OpenText, “The average cost of a data breach in 2022 was $4.35 million dollars. The loss from BEC attacks in 2022 was $10.3 billion dollars. The loss from identity fraud in 2022 was $43 billion dollars.” These are not small numbers and they are increasing every year. “Cyber insurance revenues will grow from $13.3 billion in 2022 to $84.6 billion in 2030, increasing an average of 26% annually.” (Open Text) The average cost of a data breach is greater than revenue.

Cybersecurity incidents are costly. It’s not just about the breach of information. According to OpenText, “The average cost of a data breach in 2022 was $4.35 million dollars. The loss from BEC attacks in 2022 was $10.3 billion dollars. The loss from identity fraud in 2022 was $43 billion dollars.” These are not small numbers and they are increasing every year. “Cyber insurance revenues will grow from $13.3 billion in 2022 to $84.6 billion in 2030, increasing an average of 26% annually.” (Open Text) The average cost of a data breach is greater than revenue.

Cyber Insurance

Let’s talk cyber insurance. Whether your business is small or large, in the public or private sector, there is a chance for a cybersecurity incident, small or large. “In 2022, 61% of all SMBs (Server Message Blocks) experienced an attack.” (BlackFog) MSPs (Managed Service Providers) recommend cyber insurance for SMBs. Due to the rise of increased payouts, insurance premiums are increasing as well as frequent audits to ensure compliance with insurance requirements. Requirements to meet eligibility are also increasing.

Not all insurance carriers offer cyber insurance and due to the increase in claims, if you don’t have the tools to mitigate, they will not pay for the claim. Make sure to read the fine print and understand what is not covered with your cyber insurance.

Warranty vs. Cyber Insurance

| Warranty | Cyber Insurance |

| Covers a limited set of risks | Offers comprehensive protection |

| Limited to first party incidents only | Offers the option of both first and third-party coverage |

| Protected under consumer laws | Financially regulated product |

| Is usually standardized | In some cases, can be customized |

| Simple process which requires agreeing to a product or a service terms and conditions | Requires a detailed application process to access risk |

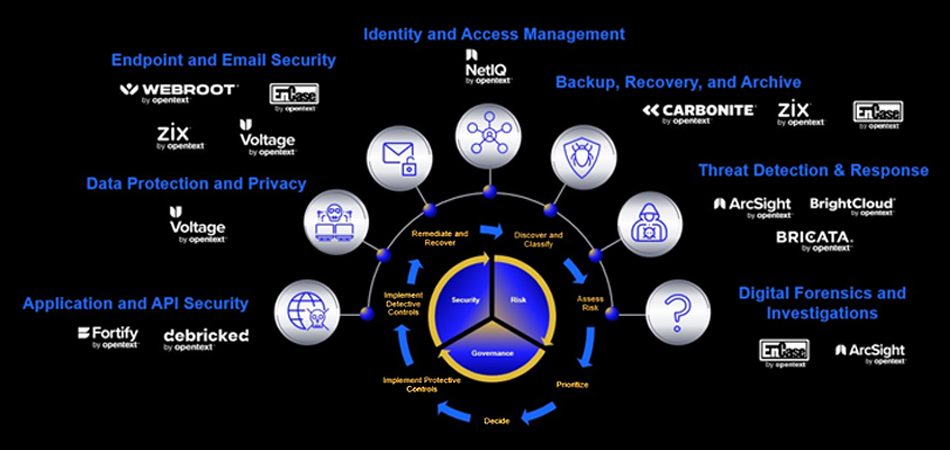

This is where cyber resilience comes into play. Cyber resilience is the ability of an organization to enable business acceleration (enterprise resiliency) by preparing for, responding to, and recovering from cyber threats. A cyber-resilient organization can adapt to known and unknown crises, threats, adversities, and challenges. At Graphic Imaging Services, Inc. we are an authorized seller for OpenText. OpenText Cybersecurity has a comprehensive portfolio of cybersecurity solutions to help customers across their Cybersecurity journey. With focus on simplicity and high efficacy, OpenText Cybersecurity enables end-to-end security protection for their customers – from users, to devices to applications to data. With the breadth and depth of cybersecurity solutions, they help customers effectively reduce risk, preserve trust, minimize disruption, and be cyber resilient.

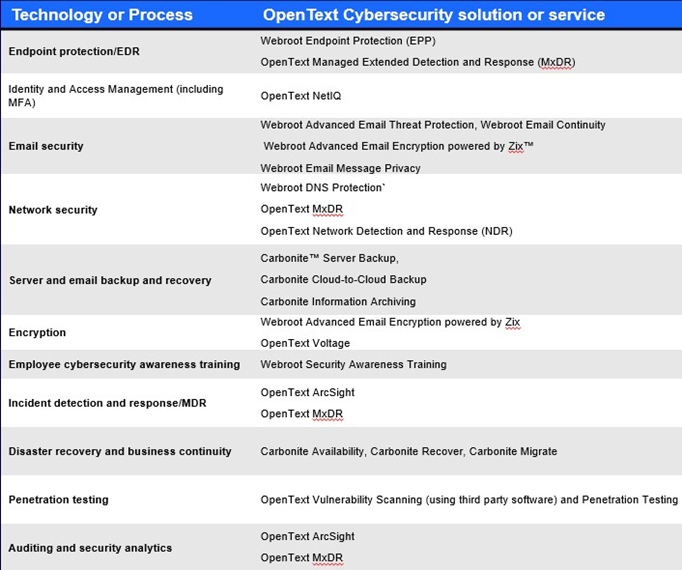

How OpenText maps to cyber insurance requirements?

Cyber threats are a constant challenge for organizations, and a successful data breach can cause substantial operational, financial and reputational damages. 54% of organizations have lost customers or revenue due to downtime. Public companies lose an estimated 8.6% of their value after a successful cyber breach. To combat cyber threats, organizations need to implement cyber resiliency strategy that embeds security and data management solutions and best practices across the business ecosystem. A cyber resilient solution helps organizations to respond quickly to threats, minimize the damage, restore business operations quickly and maintain security posture to be compliant with regulatory requirements.

Your trusted partner to achieve cyber resilience

OpenText is one of the largest security solution providers in the industry. They help IT gain visibility across their complex environments, quickly detect and prevent threats, respond quickly to internal and external threats to understand scope and impact, and comply with information security, regulatory and industry standards.

OpenText solutions help organizations:

– Reduce risk with multi-vector protection against attack surfaces.

– Minimize business disruption with ability to recover data within minutes.

– Investigate and analyze threats to understand scope and impact.

– Gain rapid insights leveraging real-time contextual threat intelligence.

At the same time, OpenText help them optimize resources and skillset shortages while addressing new and emerging threat vectors with high efficacy. Unlike other security providers, they provide the breadth and depth of comprehensive end-to-end security solutions – including brand names we’ve acquired such as Webroot, Carbonite, Zix, BrightCloud, Micro Focus and EnCase — to address each step of an organization’s journey to enhance security and trust.

Sources: OpenText